Introduction

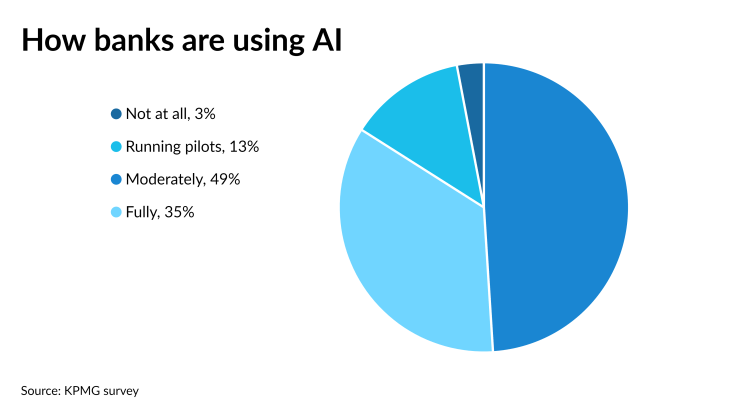

In an era where technology reshapes our everyday lives, Artificial Intelligence (AI) stands at the forefront of transforming the financial landscape. Traditional banking institutions and fintech revolutionaries alike are racing to harness AI's potential, aiming to redefine investment research, customer interaction, and fraud management. With an eye on the future, a staggering 77% of financial giants plan to amplify their AI investments. This surge underscores a pivotal shift towards AI-driven financial services, promising to inject over $1 trillion in value by 2035. But why is AI the heart of finance's future, and how can your institution navigate its tidal wave of opportunities?

In this revolutionary guide, we will throw light on several opportunities to leverage AI in finance and banking industry and how to kickstart your AI journey to stay ahead of the curve.

AI in Finance: Why It Is the Need of the Hour?

AI in finance is not just an option, but a necessity. Its application spans from improving customer experiences to boosting revenue and streamlining operations. Financial giants and agile FinTech organizations alike are harnessing AI's potential to personalize investment strategies, detect and prevent fraud in real-time, and automate tedious processes with unprecedented efficiency.

AI in Finance: Transformative Use Cases

AI has many uses in finance, and we expect more to develop soon. This guide will concentrate on some of the key areas.

- Predictive Analytics for Investment Management: Imagine a world where investments are guided by an AI that not only understands market trends but predicts them. By analyzing historical data and market dynamics, AI-driven predictive analytics offer real-time insights and forecasts, empowering institutions to make strategic decisions for sustained growth.

- Robotic Process Automation (RPA): The era of manual document processing is over. AI-driven RPA solutions are revolutionizing how financial documents are handled, extracting and analyzing data with precision, thereby streamlining loan processing and fraud detection while enhancing customer onboarding experiences.

- Cybersecurity and Fraud Detection: In a digital age where security threats evolve by the minute, AI security systems stand guard, predicting and adapting to cyber threats with a data-driven vigilance that ensures your institution's and customers' safety.

- Personalized Banking with Advanced Chatbots: Our sophisticated AI chatbots are redefining customer service, offering personalized financial advice and support that mirrors a personal financial advisor, thereby transforming customer interactions into meaningful engagements.

- AI-Driven Loan and Credit Decisioning: Breaking the mold of traditional credit assessments, AI models consider a wider array of data points, including non-traditional ones, to offer a more inclusive financial landscape and tap into new customer segments. Machine learning-driven credit scoring offers quick and precise evaluations with less bias. By leveraging AI to evaluate potential borrowers using alternative data like rent payment history, job function, and financial behavior, it not only enhances the accuracy of risk assessment by focusing on crucial indicators but also allows for the evaluation of individuals with no credit history.

- Regulatory Compliance: Navigating the complex web of regulatory compliance is now simpler with AI, automating the tracking and analysis of regulatory changes and modeling risk scenarios for effective risk management.

- Digital Marketing in BFSI: AI-powered digital marketing strategies are not just about engagement; they're about creating personalized interactions that resonate with each customer, driving conversions, and fostering brand loyalty.

Implementing AI in Finance

To successfully integrate AI in finance, companies need a well-thought-out strategy that links AI objectives to solving business challenges and crafting a solid data strategy. Aligning AI implementation goals with organizational priorities, like boosting revenue, enhancing efficiency, or improving customer service, is crucial for effectiveness.

Here's a simplified approach:

- Identify Key Challenges and Priorities: Start by pinpointing the main issues your company faces and what you aim to achieve. Are you looking to increase profits, enhance customer service, or streamline operations? Focus could also be on refining investment research, enhancing fraud detection, or evaluating portfolios.

- Develop a Strong Data Strategy: The success of AI largely depends on the quality of data. It's vital to fine-tune AI models with your proprietary data for specific financial tasks. Assess the data you have, understand the formats needed, and plan for its cleaning and standardization. Also, prepare for knowledge retrieval by organizing your data for easy access and integration into AI models.

- Assess Internal Capabilities: With rapid advancements in machine learning, knowing your in-house capabilities is key. Evaluate whether you have the necessary machine learning expertise, data strategy, tools, and partnerships to effectively implement AI.

- Ensure Data Security: Financial firms handle sensitive data, making security paramount. Ensure that any AI tools or cloud-based solutions comply with your company's security policies to protect confidential information.

- Adopt a Phased Approach: Begin with small, manageable projects that address specific problems or customer needs. Experiment and pilot different AI solutions quickly, and then gradually scale up based on their success and impact on your business goals.

Conclusion

The journey to AI transformation in finance begins with a clear vision. It requires aligning AI initiatives with business objectives, underpinned by a robust data strategy and a deep understanding of the technology's nuances. From prioritizing use cases to defining data strategies and ensuring security, the roadmap to AI adoption is both strategic and systematic.

At

Futurism Technologies, we don't just talk about AI; we breathe life into it. Our suite of

AI solutions for BFSI, from predictive analytics and RPA to cybersecurity, digital marketing, and beyond, is designed to catapult your institution into the future of finance. With a focus on personalization, efficiency, and security, we empower you to not just navigate but lead the financial services revolution.

Want to transform your financial services with AI? Explore our

AI solutions and lead the charge or drop us a note

here.